|

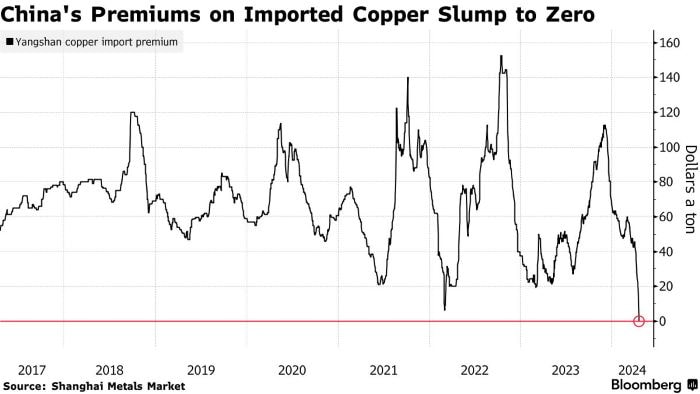

In the intricate world of copper trading, the "Yangshan Copper Premium" stands as a pivotal indicator, offering crucial insights into the dynamics of Chinese copper imports. Named after the bustling Yangshan port in Shanghai, where a substantial portion of China's copper imports is funneled, this premium captures the additional cost incurred by Chinese buyers for imported copper, juxtaposed against prevailing global exchange prices, notably those on the London Metal Exchange (LME). Rooted in the intricate interplay of supply and demand dynamics, shipping logistics, import tariffs, inventory levels, and prevailing market sentiment, this premium serves as a barometer for the vigor of Chinese copper demand, import trends, and the broader market landscape. Let's delve deeper into its significance for analysts and traders seeking to navigate the complexities of the copper market. This premium is influenced by various factors, including supply and demand dynamics in the Chinese market, shipping costs, import duties, inventory levels, and market sentiment. Traders and analysts closely monitor changes in the Yangshan copper premium as it provides insights into the strength of Chinese copper demand, import trends, and market conditions. Lets take a closer look. If the Yangshan copper premium sinks to zero or approaches zero, it typically indicates a few significant developments in the copper market and Chinese economy: Weakened Demand: A zero or near-zero premium suggests subdued demand for imported copper in China. This could be due to various factors such as slower economic growth, reduced industrial activity, or weaker demand from key sectors like construction and manufacturing. A lack of premium indicates that Chinese buyers are not willing to pay a premium for imported copper over the prevailing global exchange prices. Market Oversupply: When the premium on imported copper disappears, it may suggest an oversupply situation in the Chinese market. This oversupply could result from increased domestic production, higher inventory levels, or reduced consumption. A surplus of copper in the market can lead to downward pressure on prices as sellers compete to offload excess supply. Currency Effects: Changes in currency exchange rates, particularly fluctuations in the value of the Chinese yuan (CNY) relative to other currencies, can also impact the Yangshan copper premium. A strengthening yuan or weakening of other currencies may reduce the cost of importing copper, narrowing or eliminating the premium. Global Market Dynamics: The disappearance of the Yangshan copper premium can also reflect broader trends in the global copper market. Changes in international supply and demand, trade policies, geopolitical developments, and macroeconomic factors can all influence the premium paid on Chinese copper imports. Overall, a sinking Yangshan copper premium signals weaker demand, market oversupply, or changes in currency dynamics, providing valuable insights into the state of the Chinese copper market and broader economic conditions. Traders, analysts, and policymakers closely monitor changes in the premium as part of their assessment of copper market fundamentals and price trends. The Yangshan Copper Premium has extended a months-long decline to reach zero for the first time in Shanghai Metals Market data going back to 2017. The unusually low levels come just days after copper on the London Metal Exchange rallied to a two-year high near $10,000 a ton.

We know that if the Yangshan copper premium sinks to zero or approaches zero, it typically indicates a few significant developments in the copper market and Chinese economy such as extremely weak demand for imported cargoes or it may suggest an oversupply situation in the Chinese market. Copper is up nearly 15% this year on the LME driven by fund speculation, according to the CoT positioning data. Is this surge in price action based on the narratives of global recovery in manufacturing and growth in demand from new-energy applications driving demand? Your guess is as good as mine on that one! However, the fact remains that in China, inventories are rising, spot prices are trading at a discount to futures, and smelters are turning to exports. This tells us that the Chinese copper market is oversupplied and experiencing weaker demand. Conclusion The Yangshan Copper Premium, once a steadfast gauge of Chinese copper import vitality, has taken an unprecedented plunge, reaching zero for the first time in recent history. This development occurs amidst a backdrop of soaring copper prices on the London Metal Exchange, propelled by speculative fervor and optimistic narratives of global economic resurgence and burgeoning demand from green energy sectors. Yet, beneath the surface, the Chinese copper market tells a starkly different story—a tale of rising inventories, tepid spot prices, and smelters seeking solace in export avenues. As the age-old adage goes, "the cure for high prices is high prices," and in China's copper realm, this rings truer than ever. With demand flagging amidst soaring prices, the once-booming appetite for copper is dwindling, casting shadows over the copper market's trajectory. For traders and analysts, attuned to the nuanced dance of supply and demand, this downturn in the Yangshan Copper Premium signals a cautionary tale, a harbinger of challenges and opportunities lurking in the ever-evolving landscape of copper trading.

0 Comments

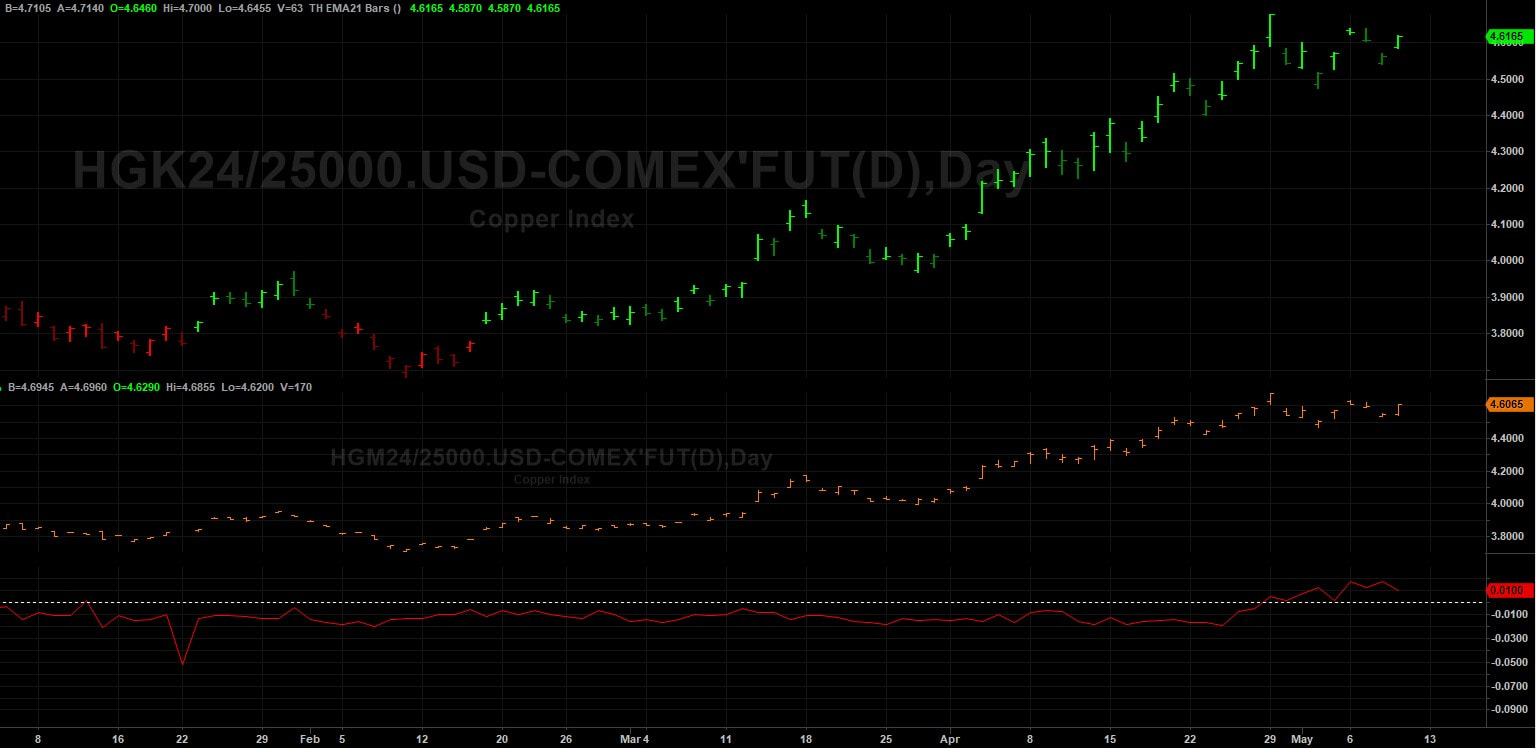

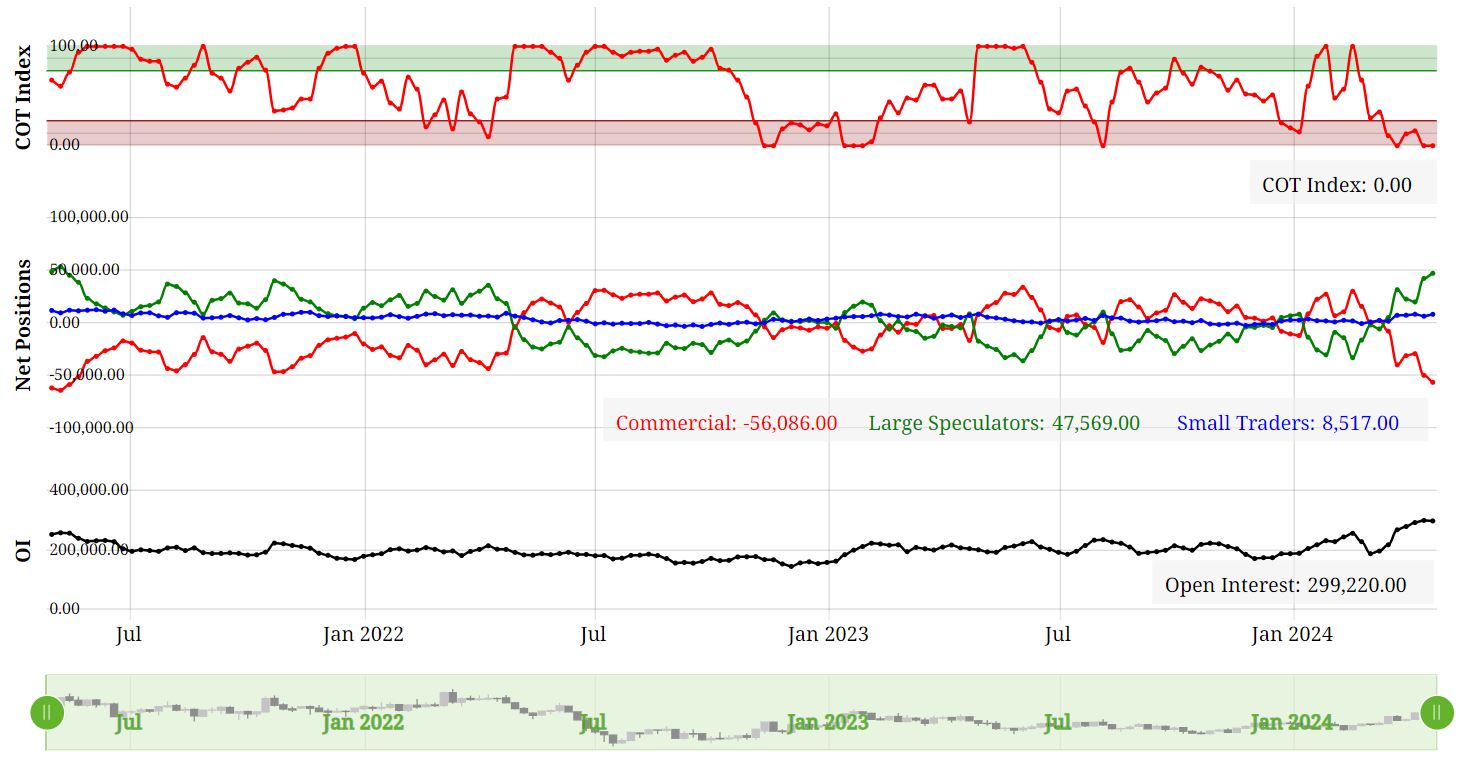

As the copper market continues to captivate investors, the recent surge in copper prices has sparked discussions among traders and hedge fund managers about whether the rally has extended beyond reasonable bounds. In this artcicle, we delve into the dynamics shaping the copper market and present a compelling case for a potential downward correction in prices. Copper's Remarkable Run Over the past month, copper prices, particularly on the London Metal Exchange (LME), have witnessed a remarkable ascent, breaching the $10,000 per ton mark for the first time in two years and COMEX copper rallying to over $7.60 per ounce in recent days. This has been underpinned by concerns surrounding tight global mine supply and heightened demand from the burgeoning green energy sector. While the long-term outlook for copper remains bullish, short-term indicators suggest that a correction may be on the horizon. Several factors contribute to this assessment: China's Property Market Woes Despite resilient manufacturing activity in China driven by overseas demand and technological advancements, the ongoing crisis in China's property market continues to cast a shadow. Housing completions, a key gauge of copper demand, have witnessed a significant decline year-on-year, signaling a slowdown in demand for the red metal. Elevated Copper Inventories in China Copper inventories in China have surged to seasonally high levels, dampening expectations for a traditional second-quarter surge in demand. High refined copper output, coupled with tepid domestic demand, has led to a buildup in stocks, prompting smelters to export refined copper to overseas markets. Record Refined Copper Output in China Despite spot treatment charges dipping below zero, Chinese smelters have shown no signs of scaling back production. Refined copper output in China has surged to near all-time highs, driven by the country's strategic emphasis on green energy initiatives. China's Premium on Imported Copper Slumps The premium on imported copper in China has plummeted to zero, reflecting subdued buying interest amid soaring international copper prices. This decline in premium underscores the cooling appetite for imported copper in the Chinese market. US Monetary Policy Considerations Beyond China, the trajectory of US monetary policy looms large over copper prices. Elevated interest rates and a strengthening dollar have historically exerted downward pressure on industrial metals. Expectations of a delayed Fed rate cut could further bolster the US dollar and dampen investor sentiment, potentially leading to lower copper prices. Positioning: A Crowded Market We've got extreme positionining across the board in the copper market. Commercials are at an extreme net short. Large specs are at an extreme net long as are the small specs now. Now this condition could continue for a while longer and certianly doesn't mean we should sell this market. We could even see new highs over the next few weeks. However, what it does tell us, is is that the risk/reward ratio at these levels is not good. Futures Spreads We have seen the COMEX nearby futres contract go into backwardation over the next month out, which does suggest tightening supplies as the nearby contract is bid. However, it is a very small premium currently, but nonetheless, we need to pay attention to this over the next few weeks. Seasonal Tendencies The seasonal tendency for May is down. Now I wouldn't use seasonals on their own. They are just tendencies and can be overridden by fundamentals. However, when used in combination with other factors such positioning and spreads, they can be very useful for confirmation. In conclusion, while the long-term fundamentals supporting copper remain intact, short-term headwinds suggest a corrective phase may be in the making. I'm certainly monitoring the fundamentals, positioning, seasonals, spreads and technicals over the next few weeks before jumping into this market.

On the London Metal Exchange (LME), three-month copper prices experienced a notable 1.5% rise to $9,916 per metric ton during official open-outcry trading, edging closer to Monday's peak of $9,988, marking a two-year high. BHP Group's bid of $38.8 billion for Anglo American on Thursday aimed to create the world's largest copper miner, igniting further interest in the copper market. The US copper futures market is also rallying and price action is way above the 8 EMA and also above 3 Standard Deviations from the mean at $4.5995. We can see how the trend has developed following the period of rangebound trading from late November 2023 to mid March 2024. During this time price action was trading backwards and forwards around the 200 SMA and the market really wasn't that intersting during this period. COMEX Copper Futures However, lets not get too far ahead of ourselves. In China, the Yangshan premium assessed by SMM plummeted to zero for the first time on record, signaling subdued interest in importing copper, despite being the world's leading metals consumer. The Shanghai Futures Exchange (SHFE) saw a 1.9% surge in the most traded June copper contract, closing at 80,160 yuan ($11,061.13) per ton, reflecting continued fund buying momentum. Despite challenges in the Chinese market, marked by mixed indicators, including increasing refined copper imports contrasting with inventory build-ups, bullish sentiments persist in global copper markets. CoT Data Talkoing about funds, lets take alook at positioning with the CoT data. We can see that funds are holding an extreme net long position whilst the commecials are at an extreme net position compared to the last few years. This is indicating that we have a highly crowded market and opens the door to fund liquidation in the near term. COMEX Copper Futures - CoT Data Seasonality Lets take a look at the seasonal tendancy for COMEX copper with the 5, 10 and 15 year average. As we can see from the figure below, it's not clear cut. The 5 years average shows a bias to the downside whislt the 15 year average shows a bias to the upside. COMEX Copper Seasonality Optimism from Analysts and Invement Firms According to Citi, copper prices could soar to $12,000 per ton within the next three months, driven by supply constraints and rising demand, particularly in green industries. Furthermore, Wall Street remains bullish on copper, with Standard Chartered favoring it as their top pick across the base metals complex for 2024. Major investment firms like BlackRock and Trafigura Group anticipate even higher copper prices, necessitating substantial investments in new mines to meet growing demand from sectors such as electric vehicles and renewable energy. With that said, we need to consider the challenges in the Chinese market and the micro copper indicators that could potentially cap near-term price gains. Summary

While copper futures on the LME surged to $10,033.50 per ton, reaching levels unseen since April 2022, this year's rally is underpinned by optimism about the global economy's trajectory, despite persisting challenges in the Chinese spot market. |

AuthorTim the trader Archives

January 2025

Categories |

Site powered by Weebly. Managed by iPage

RSS Feed

RSS Feed