|

The gold market is a cornerstone of global finance, serving as a hedge against economic uncertainty, inflation, and currency fluctuations. For traders and hedge fund managers, understanding the fundamental factors that drive the gold market is crucial for developing informed trading strategies and making sound investment decisions. This article delves into the key supply and demand dynamics, economic indicators, geopolitical influences, and market sentiment that shape the gold market. Supply and Demand DynamicsSupply Factors : The supply of gold primarily comes from mining production and recycling. Major gold-producing countries include China, Australia, Russia, and the United States. The discovery of new mines and advancements in mining technology can impact the overall supply. Additionally, recycled gold from old jewelry, electronics, and other sources contributes significantly to the market. Central banks also play a crucial role by buying and selling gold reserves, influencing overall supply and demand. Demand Factors: Jewelry demand, especially in culturally significant markets like India and China, remains a major driver of gold consumption. Investment demand, driven by economic uncertainty, inflation fears, and market volatility, sees investors turning to gold as a safe-haven asset. Gold is also essential in various industrial applications, particularly in electronics due to its superior conductive properties. Economic Indicators and ConditionsInflation and Interest Rates: Gold is widely regarded as a hedge against inflation. When inflation rates rise, the purchasing power of fiat currencies declines, leading investors to seek refuge in gold. Conversely, interest rates have an inverse relationship with gold prices. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, making it more attractive. Currency Fluctuations: The strength of the US dollar significantly impacts gold prices, as gold is typically priced in dollars. A weaker dollar makes gold cheaper for foreign buyers, increasing demand, while a stronger dollar has the opposite effect. Geopolitical FactorsPolitical Uncertainty and Tensions: Political instability, elections, conflicts, and changes in government policies can lead to increased demand for gold. During times of geopolitical tension, such as wars or terrorist activities, investors flock to gold as a safe-haven asset, driving up prices. We've seen this at work earlier in 2024 with the geo-political tensions in the Middle East. Market Sentiment and SpeculationInvestor Behavior: The attitudes and behaviors of investors significantly influence gold prices. Positive sentiment towards gold can drive prices up, while negative sentiment can lead to a sell-off. Speculative activities in the futures and options markets also contribute to short-term price volatility. Central Bank PoliciesMonetary Policy: Central banks' monetary policies, particularly those related to interest rates and money supply, have substantial effects on gold prices. Expansionary monetary policy, characterized by low-interest rates and increased money supply, often leads to higher gold prices. Gold Reserves Management: Decisions by central banks to increase or decrease their gold reserves can signal their confidence in gold as a monetary asset, influencing its demand and price. Global Economic HealthEconomic Growth and Recession: During periods of robust economic growth, investment demand for gold may decrease as investors seek higher returns in equity markets. Conversely, during economic downturns, gold demand typically increases as investors look for stability and wealth preservation. Technological AdvancementsMining Technology: Advancements in mining technology can make gold extraction more efficient and cost-effective, potentially increasing supply. Innovations in industrial uses of gold, such as in electronics and medical devices, can also drive demand. Regulatory ChangesMining and Financial Regulations: hanges in environmental and mining regulations can impact the cost and feasibility of gold mining operations. Financial market regulations affecting derivatives and ETFs can also influence gold trading. Market Liquidity and AccessibilityMarket Access and Liquidity: The ease with which investors can buy and sell gold, including through online platforms and financial products like ETFs, can influence demand. Overall market liquidity, meaning the ability to quickly and easily trade gold without affecting its price, plays a crucial role in its attractiveness as an investment. ConclusionFor traders and hedge fund managers, a comprehensive understanding of the fundamental factors that drive the gold market is essential. By analyzing supply and demand dynamics, economic indicators, geopolitical influences, market sentiment, central bank policies, and technological advancements, investors can develop more informed and strategic approaches to trading gold. In a market characterized by volatility and uncertainty, staying attuned to these fundamental factors can provide a critical edge in navigating the complexities of the gold market.

0 Comments

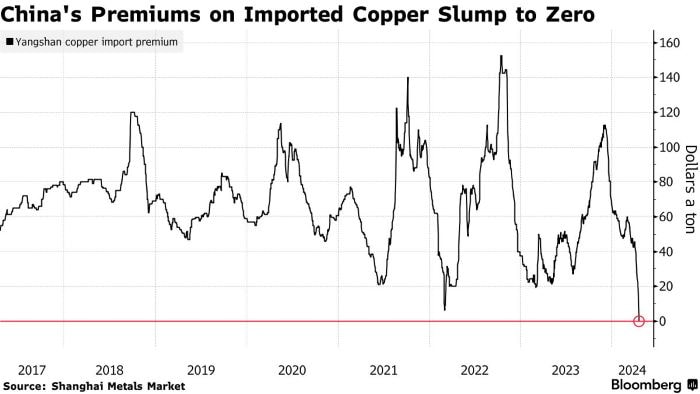

In the intricate world of copper trading, the "Yangshan Copper Premium" stands as a pivotal indicator, offering crucial insights into the dynamics of Chinese copper imports. Named after the bustling Yangshan port in Shanghai, where a substantial portion of China's copper imports is funneled, this premium captures the additional cost incurred by Chinese buyers for imported copper, juxtaposed against prevailing global exchange prices, notably those on the London Metal Exchange (LME). Rooted in the intricate interplay of supply and demand dynamics, shipping logistics, import tariffs, inventory levels, and prevailing market sentiment, this premium serves as a barometer for the vigor of Chinese copper demand, import trends, and the broader market landscape. Let's delve deeper into its significance for analysts and traders seeking to navigate the complexities of the copper market. This premium is influenced by various factors, including supply and demand dynamics in the Chinese market, shipping costs, import duties, inventory levels, and market sentiment. Traders and analysts closely monitor changes in the Yangshan copper premium as it provides insights into the strength of Chinese copper demand, import trends, and market conditions. Lets take a closer look. If the Yangshan copper premium sinks to zero or approaches zero, it typically indicates a few significant developments in the copper market and Chinese economy: Weakened Demand: A zero or near-zero premium suggests subdued demand for imported copper in China. This could be due to various factors such as slower economic growth, reduced industrial activity, or weaker demand from key sectors like construction and manufacturing. A lack of premium indicates that Chinese buyers are not willing to pay a premium for imported copper over the prevailing global exchange prices. Market Oversupply: When the premium on imported copper disappears, it may suggest an oversupply situation in the Chinese market. This oversupply could result from increased domestic production, higher inventory levels, or reduced consumption. A surplus of copper in the market can lead to downward pressure on prices as sellers compete to offload excess supply. Currency Effects: Changes in currency exchange rates, particularly fluctuations in the value of the Chinese yuan (CNY) relative to other currencies, can also impact the Yangshan copper premium. A strengthening yuan or weakening of other currencies may reduce the cost of importing copper, narrowing or eliminating the premium. Global Market Dynamics: The disappearance of the Yangshan copper premium can also reflect broader trends in the global copper market. Changes in international supply and demand, trade policies, geopolitical developments, and macroeconomic factors can all influence the premium paid on Chinese copper imports. Overall, a sinking Yangshan copper premium signals weaker demand, market oversupply, or changes in currency dynamics, providing valuable insights into the state of the Chinese copper market and broader economic conditions. Traders, analysts, and policymakers closely monitor changes in the premium as part of their assessment of copper market fundamentals and price trends. The Yangshan Copper Premium has extended a months-long decline to reach zero for the first time in Shanghai Metals Market data going back to 2017. The unusually low levels come just days after copper on the London Metal Exchange rallied to a two-year high near $10,000 a ton.

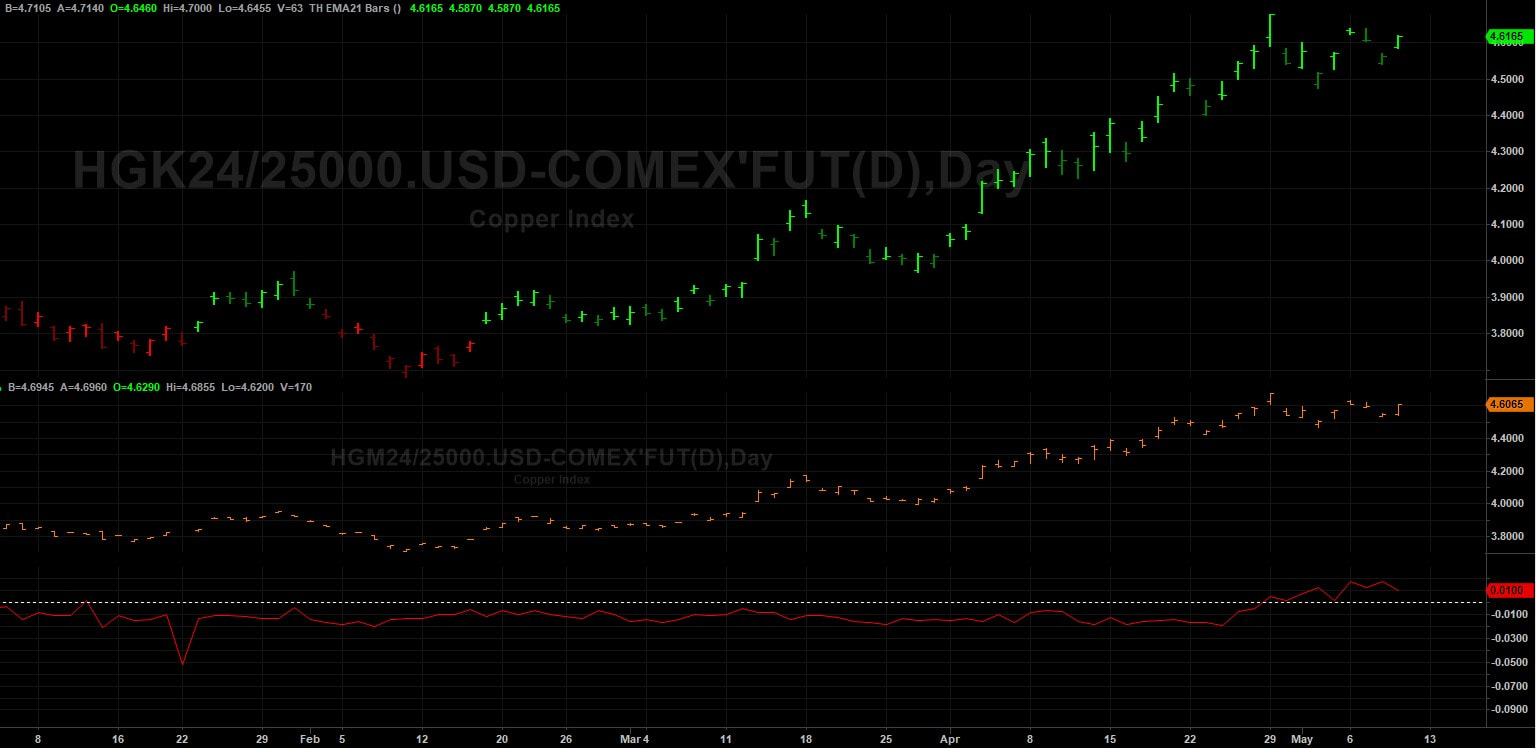

We know that if the Yangshan copper premium sinks to zero or approaches zero, it typically indicates a few significant developments in the copper market and Chinese economy such as extremely weak demand for imported cargoes or it may suggest an oversupply situation in the Chinese market. Copper is up nearly 15% this year on the LME driven by fund speculation, according to the CoT positioning data. Is this surge in price action based on the narratives of global recovery in manufacturing and growth in demand from new-energy applications driving demand? Your guess is as good as mine on that one! However, the fact remains that in China, inventories are rising, spot prices are trading at a discount to futures, and smelters are turning to exports. This tells us that the Chinese copper market is oversupplied and experiencing weaker demand. Conclusion The Yangshan Copper Premium, once a steadfast gauge of Chinese copper import vitality, has taken an unprecedented plunge, reaching zero for the first time in recent history. This development occurs amidst a backdrop of soaring copper prices on the London Metal Exchange, propelled by speculative fervor and optimistic narratives of global economic resurgence and burgeoning demand from green energy sectors. Yet, beneath the surface, the Chinese copper market tells a starkly different story—a tale of rising inventories, tepid spot prices, and smelters seeking solace in export avenues. As the age-old adage goes, "the cure for high prices is high prices," and in China's copper realm, this rings truer than ever. With demand flagging amidst soaring prices, the once-booming appetite for copper is dwindling, casting shadows over the copper market's trajectory. For traders and analysts, attuned to the nuanced dance of supply and demand, this downturn in the Yangshan Copper Premium signals a cautionary tale, a harbinger of challenges and opportunities lurking in the ever-evolving landscape of copper trading. As the copper market continues to captivate investors, the recent surge in copper prices has sparked discussions among traders and hedge fund managers about whether the rally has extended beyond reasonable bounds. In this artcicle, we delve into the dynamics shaping the copper market and present a compelling case for a potential downward correction in prices. Copper's Remarkable Run Over the past month, copper prices, particularly on the London Metal Exchange (LME), have witnessed a remarkable ascent, breaching the $10,000 per ton mark for the first time in two years and COMEX copper rallying to over $7.60 per ounce in recent days. This has been underpinned by concerns surrounding tight global mine supply and heightened demand from the burgeoning green energy sector. While the long-term outlook for copper remains bullish, short-term indicators suggest that a correction may be on the horizon. Several factors contribute to this assessment: China's Property Market Woes Despite resilient manufacturing activity in China driven by overseas demand and technological advancements, the ongoing crisis in China's property market continues to cast a shadow. Housing completions, a key gauge of copper demand, have witnessed a significant decline year-on-year, signaling a slowdown in demand for the red metal. Elevated Copper Inventories in China Copper inventories in China have surged to seasonally high levels, dampening expectations for a traditional second-quarter surge in demand. High refined copper output, coupled with tepid domestic demand, has led to a buildup in stocks, prompting smelters to export refined copper to overseas markets. Record Refined Copper Output in China Despite spot treatment charges dipping below zero, Chinese smelters have shown no signs of scaling back production. Refined copper output in China has surged to near all-time highs, driven by the country's strategic emphasis on green energy initiatives. China's Premium on Imported Copper Slumps The premium on imported copper in China has plummeted to zero, reflecting subdued buying interest amid soaring international copper prices. This decline in premium underscores the cooling appetite for imported copper in the Chinese market. US Monetary Policy Considerations Beyond China, the trajectory of US monetary policy looms large over copper prices. Elevated interest rates and a strengthening dollar have historically exerted downward pressure on industrial metals. Expectations of a delayed Fed rate cut could further bolster the US dollar and dampen investor sentiment, potentially leading to lower copper prices. Positioning: A Crowded Market We've got extreme positionining across the board in the copper market. Commercials are at an extreme net short. Large specs are at an extreme net long as are the small specs now. Now this condition could continue for a while longer and certianly doesn't mean we should sell this market. We could even see new highs over the next few weeks. However, what it does tell us, is is that the risk/reward ratio at these levels is not good. Futures Spreads We have seen the COMEX nearby futres contract go into backwardation over the next month out, which does suggest tightening supplies as the nearby contract is bid. However, it is a very small premium currently, but nonetheless, we need to pay attention to this over the next few weeks. Seasonal Tendencies The seasonal tendency for May is down. Now I wouldn't use seasonals on their own. They are just tendencies and can be overridden by fundamentals. However, when used in combination with other factors such positioning and spreads, they can be very useful for confirmation. In conclusion, while the long-term fundamentals supporting copper remain intact, short-term headwinds suggest a corrective phase may be in the making. I'm certainly monitoring the fundamentals, positioning, seasonals, spreads and technicals over the next few weeks before jumping into this market.

The Impact of Extreme Weather and Disease Outbreak At the heart of the cocoa crisis lie fundamental factors exerting profound influence on market dynamics. Key among these are adverse weather conditions and disease outbreaks in West Africa, which have severely impacted cocoa production. Agriculture in this region is particularly susceptible to the warm phase of the El Niño Southern Oscillation (ENSO) cycle, which often results in drier and warmer climates. Recent months have witnessed intense heatwaves and drought, exacerbating the challenges faced by cocoa farmers. However, such conditions are typical during El Niño years, and its not solely the temperatures that are of concern but also the extremes in rainfall, which have triggered outbreaks of diseases. Late last year, West Africa experienced excessive rainfall, leading to a surge in "Black pod disease," a fungal infection that typically follows the wet season and can decimate entire cocoa harvests if left untreated. Although copper-based fungicides offer some control over the disease, their accessibility and affordability for farmers remain limited. Following the period of heavy rain, West Africa encountered unusually dry conditions, facilitating the spread of the "Swollen shoot virus." This virus, unique to the region, is transmitted by mealybugs and results in significant yield losses of up to 25% in the first year of infection and 50% in the second. Despite decades of efforts, including extensive tree removal, eradication of the virus remains a formidable challenge. The International Cocoa Organization and industry experts predict a substantial decline in global cocoa production, estimated at around half a million tonnes this year, constituting approximately 10% of the world's typical harvest. This forecast follows two consecutive years of deficit, signaling a significant shortfall in cocoa supplies. The Ivory Coast and Ghana collectively account for nearly 60% of global cocoa production. The Impact of Illegal Gold Mining Operations Cocoa production faces additional challenges beyond the impact of El Niño and extreme weather conditions. In West Africa, illegal gold mining operations have encroached upon vast swaths of fertile cocoa land in Ghana, leading to the destruction of vegetation and ecosystems. These operations can occupy large areas of land that were previously used for cocoa cultivation, displacing farmers and disrupting agricultural activities. For cocoa farmers whose land is taken over by illegal mining operations, the consequences can be devastating. Many farmers rely on cocoa cultivation as their primary source of income, and the loss of land deprives them of their livelihoods. Additionally, the environmental damage caused by mining can render the land unsuitable for future agricultural use. Technical Triggers and Regulatory Interventions

The recent gyrations in cocoa prices underscore the potency of technical triggers amplified by record low liquidity. Despite a near-tripling in cocoa futures earlier in the year, subsequent losses exceeding 20% within a single week highlight the susceptibility of the market to speculative forces. The emergence of algorithmic funds, coupled with the retreat of traditional players like hedge funds, further exacerbates price volatility, as observed in the recent fluctuations in July London cocoa futures. Regulatory interventions, exemplified by the ICE exchange's decision to increase initial margins on cocoa futures, have introduced additional complexities into the trading landscape. While intended to mitigate risk, such measures have inadvertently contributed to a contraction in liquidity, intensifying margin pressures and amplifying the risk of large variation margin calls for market participants. Navigating the Cocoa Crisis In the face of mounting challenges, traders and hedge funds are tasked with devising strategies that reconcile technical insights with a nuanced understanding of fundamental market dynamics. This demands a holistic approach that integrates comprehensive insights into crop developments, regulatory shifts, and evolving market sentiments. Adapting to the evolving landscape necessitates not only technical acumen but also a deep appreciation of the underlying fundamentals shaping cocoa price dynamics. Market participants must remain vigilant, leveraging a multifaceted understanding of the cocoa market to identify opportunities amidst the prevailing uncertainties. Conclusion As the cocoa crisis deepens, traders and hedge funds confront a formidable challenge that demands agility, foresight, and adaptability. By navigating the complexities of technical triggers, regulatory interventions, and fundamental market dynamics, market participants can position themselves to capitalize on emerging opportunities while mitigating risks effectively. In harnessing the synergies between technical expertise and fundamental insights, traders and hedge funds can navigate the cocoa crisis with resilience and proficiency, safeguarding their interests and capitalizing on market opportunities amidst the prevailing uncertainties. |

AuthorTim the trader Archives

January 2025

Categories |

Site powered by Weebly. Managed by iPage

RSS Feed

RSS Feed