|

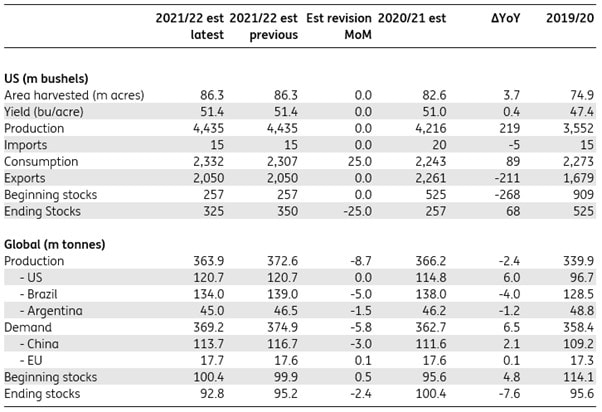

The USDA revised down global soybean production by 8.7mt, with major downgrades coming from Brazil (-5mt), Argentina (-1.5mt) and Paraguay (-1.8mt). This follows on from the USDA having already lowered its global production estimate by around 9.2mt last month. Taking into account the latest downgrade, the USDA has cumulatively lowered global soybean production estimates by around 21.3mt over the past 4 months. Its no surprise then, that prices have been increasing significantly over the last 4 months. Indeed, after the WASDE report, CBOT soybean futures above $16 per bushel for the first time since last June. The USDA now forecasts global soybean production to total around 363.9mt in 2021/22, which is down from 366.2mt in 2020/21. Global soybean demand estimates were also revised down by around 5.8mt to 369.2mt, due to softer demand from China (-3mt), as higher prices are starting to bite into consumption. As a result of the latest changes, the USDA lowered its ending stocks estimate for 2021/22 by 2.4mt to 92.8mt. The market was expecting a greater revision, with expectations of ending stocks around 91mt. For the US market, the USDA also revised down soybean inventory estimates by 25m bushels to 325m bushels, due to stronger demand. Healthy demand for soybean oil has pushed up soybean crushing in the domestic market, with domestic consumption estimates revised up from 2.31b bushels to 2.33b bushels. Domestic production and export estimates were left unchanged at around 4.44b bushels and 2.05b bushels respectively. Soybeans supply/demand balance

Source: USDA

0 Comments

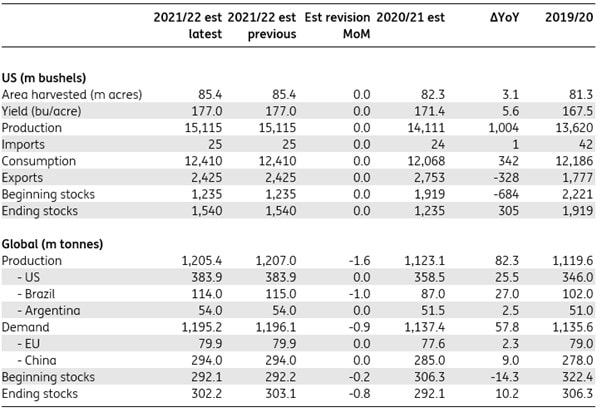

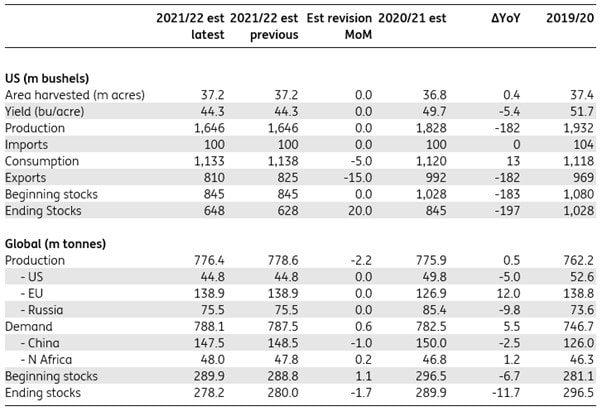

Corn Updates The USDA revised revised down global production estimates by around 1.6mt, primarily becuase of weaker supply prospects from Brazil where production was revised down by around 1mt. Global demand for corn was revised down by around 0.9mt. As a result, global corn ending stocks for 2021/22 were revised down by around 0.8mt to 302.2mt. The market was looking for a number closer to 300mt. These revisions were less than what the market was expecting, but nevertheless, the global market is still looking marginally tighter than it was last month. Corn supply/demand balance Source: USDA Wheat Updates The USDA tightened its global wheat balance marginally. Ending stocks for 2021/22 were lowered by 1.7mt to 278.2mt. This revision lower comes despite an increase in beginning stocks by around 1.1mt. Global wheat production estimates fell by 2.2mt to 776.4mt, with major downgrades seen from the Middle East due to dry weather. Global demand for wheat increased by 0.6mt to 788.1mt, on higher feed and residual demand mainly from Canada. US wheat ending stocks for 2021/22 were revised higher by 20m bushels to 648m bushels, due to weaker consumption and exports. Export estimates were lowered by around 15m bushels to 810m bushels, on slower export sales and shipments. Wheat supply/demand balance

Source: USDA |

AuthorTim the trader Archives

January 2025

Categories |

Site powered by Weebly. Managed by iPage

RSS Feed

RSS Feed