|

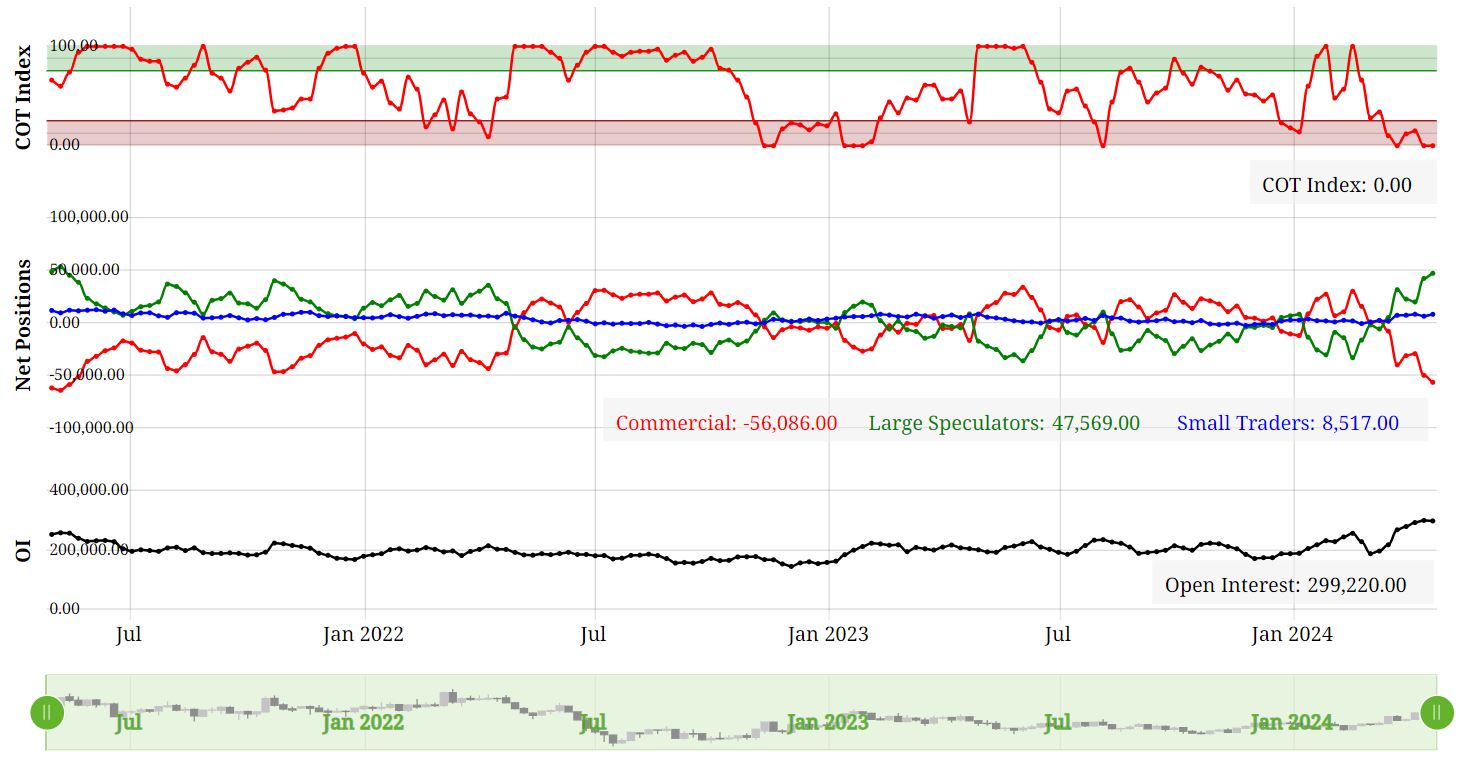

On the London Metal Exchange (LME), three-month copper prices experienced a notable 1.5% rise to $9,916 per metric ton during official open-outcry trading, edging closer to Monday's peak of $9,988, marking a two-year high. BHP Group's bid of $38.8 billion for Anglo American on Thursday aimed to create the world's largest copper miner, igniting further interest in the copper market. The US copper futures market is also rallying and price action is way above the 8 EMA and also above 3 Standard Deviations from the mean at $4.5995. We can see how the trend has developed following the period of rangebound trading from late November 2023 to mid March 2024. During this time price action was trading backwards and forwards around the 200 SMA and the market really wasn't that intersting during this period. COMEX Copper Futures However, lets not get too far ahead of ourselves. In China, the Yangshan premium assessed by SMM plummeted to zero for the first time on record, signaling subdued interest in importing copper, despite being the world's leading metals consumer. The Shanghai Futures Exchange (SHFE) saw a 1.9% surge in the most traded June copper contract, closing at 80,160 yuan ($11,061.13) per ton, reflecting continued fund buying momentum. Despite challenges in the Chinese market, marked by mixed indicators, including increasing refined copper imports contrasting with inventory build-ups, bullish sentiments persist in global copper markets. CoT Data Talkoing about funds, lets take alook at positioning with the CoT data. We can see that funds are holding an extreme net long position whilst the commecials are at an extreme net position compared to the last few years. This is indicating that we have a highly crowded market and opens the door to fund liquidation in the near term. COMEX Copper Futures - CoT Data Seasonality Lets take a look at the seasonal tendancy for COMEX copper with the 5, 10 and 15 year average. As we can see from the figure below, it's not clear cut. The 5 years average shows a bias to the downside whislt the 15 year average shows a bias to the upside. COMEX Copper Seasonality Optimism from Analysts and Invement Firms According to Citi, copper prices could soar to $12,000 per ton within the next three months, driven by supply constraints and rising demand, particularly in green industries. Furthermore, Wall Street remains bullish on copper, with Standard Chartered favoring it as their top pick across the base metals complex for 2024. Major investment firms like BlackRock and Trafigura Group anticipate even higher copper prices, necessitating substantial investments in new mines to meet growing demand from sectors such as electric vehicles and renewable energy. With that said, we need to consider the challenges in the Chinese market and the micro copper indicators that could potentially cap near-term price gains. Summary

While copper futures on the LME surged to $10,033.50 per ton, reaching levels unseen since April 2022, this year's rally is underpinned by optimism about the global economy's trajectory, despite persisting challenges in the Chinese spot market.

0 Comments

Leave a Reply. |

AuthorTim the trader Archives

January 2025

Categories |

Site powered by Weebly. Managed by iPage

RSS Feed

RSS Feed