|

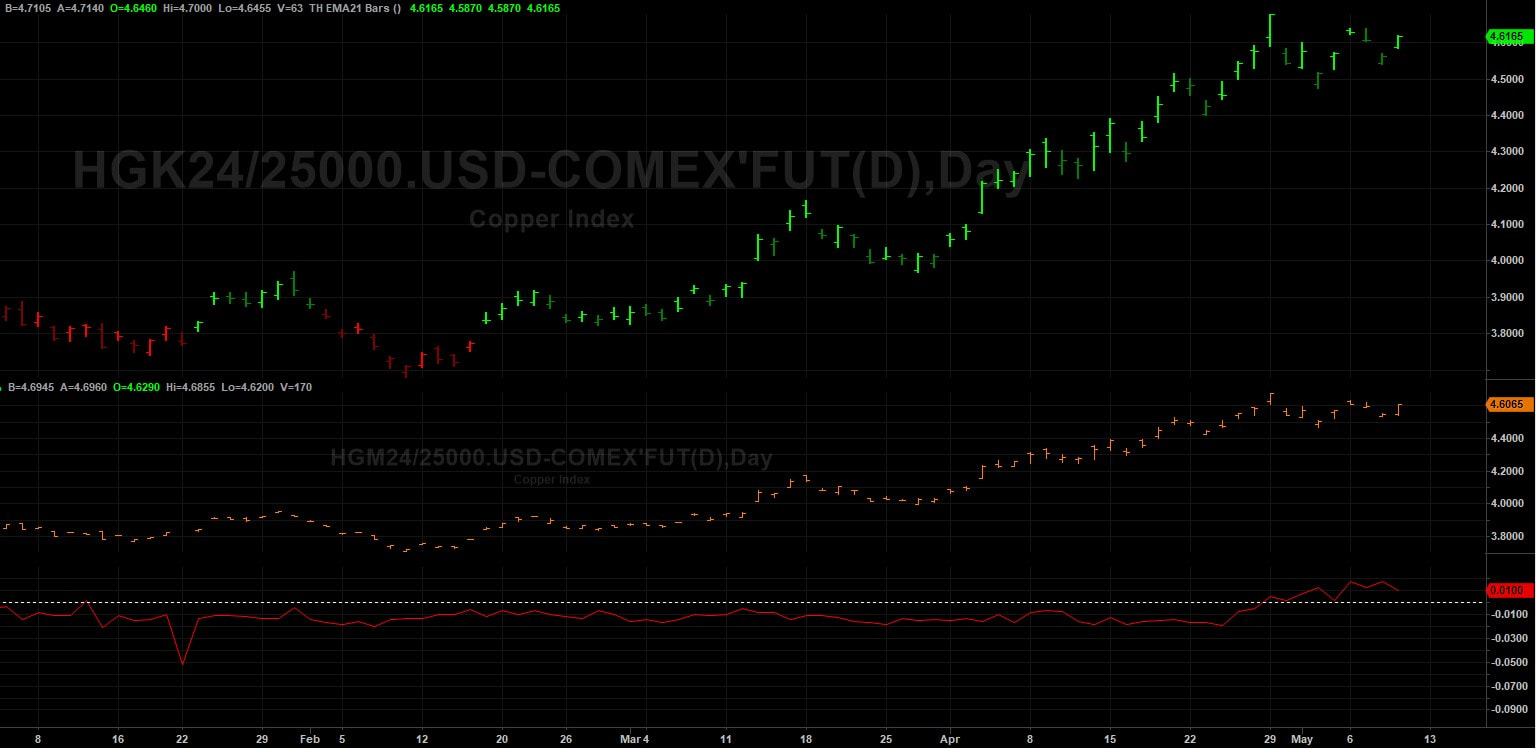

As the copper market continues to captivate investors, the recent surge in copper prices has sparked discussions among traders and hedge fund managers about whether the rally has extended beyond reasonable bounds. In this artcicle, we delve into the dynamics shaping the copper market and present a compelling case for a potential downward correction in prices. Copper's Remarkable Run Over the past month, copper prices, particularly on the London Metal Exchange (LME), have witnessed a remarkable ascent, breaching the $10,000 per ton mark for the first time in two years and COMEX copper rallying to over $7.60 per ounce in recent days. This has been underpinned by concerns surrounding tight global mine supply and heightened demand from the burgeoning green energy sector. While the long-term outlook for copper remains bullish, short-term indicators suggest that a correction may be on the horizon. Several factors contribute to this assessment: China's Property Market Woes Despite resilient manufacturing activity in China driven by overseas demand and technological advancements, the ongoing crisis in China's property market continues to cast a shadow. Housing completions, a key gauge of copper demand, have witnessed a significant decline year-on-year, signaling a slowdown in demand for the red metal. Elevated Copper Inventories in China Copper inventories in China have surged to seasonally high levels, dampening expectations for a traditional second-quarter surge in demand. High refined copper output, coupled with tepid domestic demand, has led to a buildup in stocks, prompting smelters to export refined copper to overseas markets. Record Refined Copper Output in China Despite spot treatment charges dipping below zero, Chinese smelters have shown no signs of scaling back production. Refined copper output in China has surged to near all-time highs, driven by the country's strategic emphasis on green energy initiatives. China's Premium on Imported Copper Slumps The premium on imported copper in China has plummeted to zero, reflecting subdued buying interest amid soaring international copper prices. This decline in premium underscores the cooling appetite for imported copper in the Chinese market. US Monetary Policy Considerations Beyond China, the trajectory of US monetary policy looms large over copper prices. Elevated interest rates and a strengthening dollar have historically exerted downward pressure on industrial metals. Expectations of a delayed Fed rate cut could further bolster the US dollar and dampen investor sentiment, potentially leading to lower copper prices. Positioning: A Crowded Market We've got extreme positionining across the board in the copper market. Commercials are at an extreme net short. Large specs are at an extreme net long as are the small specs now. Now this condition could continue for a while longer and certianly doesn't mean we should sell this market. We could even see new highs over the next few weeks. However, what it does tell us, is is that the risk/reward ratio at these levels is not good. Futures Spreads We have seen the COMEX nearby futres contract go into backwardation over the next month out, which does suggest tightening supplies as the nearby contract is bid. However, it is a very small premium currently, but nonetheless, we need to pay attention to this over the next few weeks. Seasonal Tendencies The seasonal tendency for May is down. Now I wouldn't use seasonals on their own. They are just tendencies and can be overridden by fundamentals. However, when used in combination with other factors such positioning and spreads, they can be very useful for confirmation. In conclusion, while the long-term fundamentals supporting copper remain intact, short-term headwinds suggest a corrective phase may be in the making. I'm certainly monitoring the fundamentals, positioning, seasonals, spreads and technicals over the next few weeks before jumping into this market.

0 Comments

Leave a Reply. |

AuthorTim the trader Archives

January 2025

Categories |

Site powered by Weebly. Managed by iPage

RSS Feed

RSS Feed