|

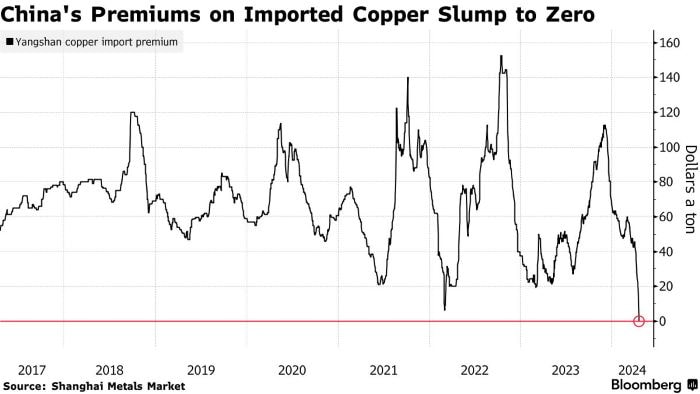

In the intricate world of copper trading, the "Yangshan Copper Premium" stands as a pivotal indicator, offering crucial insights into the dynamics of Chinese copper imports. Named after the bustling Yangshan port in Shanghai, where a substantial portion of China's copper imports is funneled, this premium captures the additional cost incurred by Chinese buyers for imported copper, juxtaposed against prevailing global exchange prices, notably those on the London Metal Exchange (LME). Rooted in the intricate interplay of supply and demand dynamics, shipping logistics, import tariffs, inventory levels, and prevailing market sentiment, this premium serves as a barometer for the vigor of Chinese copper demand, import trends, and the broader market landscape. Let's delve deeper into its significance for analysts and traders seeking to navigate the complexities of the copper market. This premium is influenced by various factors, including supply and demand dynamics in the Chinese market, shipping costs, import duties, inventory levels, and market sentiment. Traders and analysts closely monitor changes in the Yangshan copper premium as it provides insights into the strength of Chinese copper demand, import trends, and market conditions. Lets take a closer look. If the Yangshan copper premium sinks to zero or approaches zero, it typically indicates a few significant developments in the copper market and Chinese economy: Weakened Demand: A zero or near-zero premium suggests subdued demand for imported copper in China. This could be due to various factors such as slower economic growth, reduced industrial activity, or weaker demand from key sectors like construction and manufacturing. A lack of premium indicates that Chinese buyers are not willing to pay a premium for imported copper over the prevailing global exchange prices. Market Oversupply: When the premium on imported copper disappears, it may suggest an oversupply situation in the Chinese market. This oversupply could result from increased domestic production, higher inventory levels, or reduced consumption. A surplus of copper in the market can lead to downward pressure on prices as sellers compete to offload excess supply. Currency Effects: Changes in currency exchange rates, particularly fluctuations in the value of the Chinese yuan (CNY) relative to other currencies, can also impact the Yangshan copper premium. A strengthening yuan or weakening of other currencies may reduce the cost of importing copper, narrowing or eliminating the premium. Global Market Dynamics: The disappearance of the Yangshan copper premium can also reflect broader trends in the global copper market. Changes in international supply and demand, trade policies, geopolitical developments, and macroeconomic factors can all influence the premium paid on Chinese copper imports. Overall, a sinking Yangshan copper premium signals weaker demand, market oversupply, or changes in currency dynamics, providing valuable insights into the state of the Chinese copper market and broader economic conditions. Traders, analysts, and policymakers closely monitor changes in the premium as part of their assessment of copper market fundamentals and price trends. The Yangshan Copper Premium has extended a months-long decline to reach zero for the first time in Shanghai Metals Market data going back to 2017. The unusually low levels come just days after copper on the London Metal Exchange rallied to a two-year high near $10,000 a ton.

We know that if the Yangshan copper premium sinks to zero or approaches zero, it typically indicates a few significant developments in the copper market and Chinese economy such as extremely weak demand for imported cargoes or it may suggest an oversupply situation in the Chinese market. Copper is up nearly 15% this year on the LME driven by fund speculation, according to the CoT positioning data. Is this surge in price action based on the narratives of global recovery in manufacturing and growth in demand from new-energy applications driving demand? Your guess is as good as mine on that one! However, the fact remains that in China, inventories are rising, spot prices are trading at a discount to futures, and smelters are turning to exports. This tells us that the Chinese copper market is oversupplied and experiencing weaker demand. Conclusion The Yangshan Copper Premium, once a steadfast gauge of Chinese copper import vitality, has taken an unprecedented plunge, reaching zero for the first time in recent history. This development occurs amidst a backdrop of soaring copper prices on the London Metal Exchange, propelled by speculative fervor and optimistic narratives of global economic resurgence and burgeoning demand from green energy sectors. Yet, beneath the surface, the Chinese copper market tells a starkly different story—a tale of rising inventories, tepid spot prices, and smelters seeking solace in export avenues. As the age-old adage goes, "the cure for high prices is high prices," and in China's copper realm, this rings truer than ever. With demand flagging amidst soaring prices, the once-booming appetite for copper is dwindling, casting shadows over the copper market's trajectory. For traders and analysts, attuned to the nuanced dance of supply and demand, this downturn in the Yangshan Copper Premium signals a cautionary tale, a harbinger of challenges and opportunities lurking in the ever-evolving landscape of copper trading.

0 Comments

Leave a Reply. |

AuthorTim the trader Archives

January 2025

Categories |

Site powered by Weebly. Managed by iPage

RSS Feed

RSS Feed