|

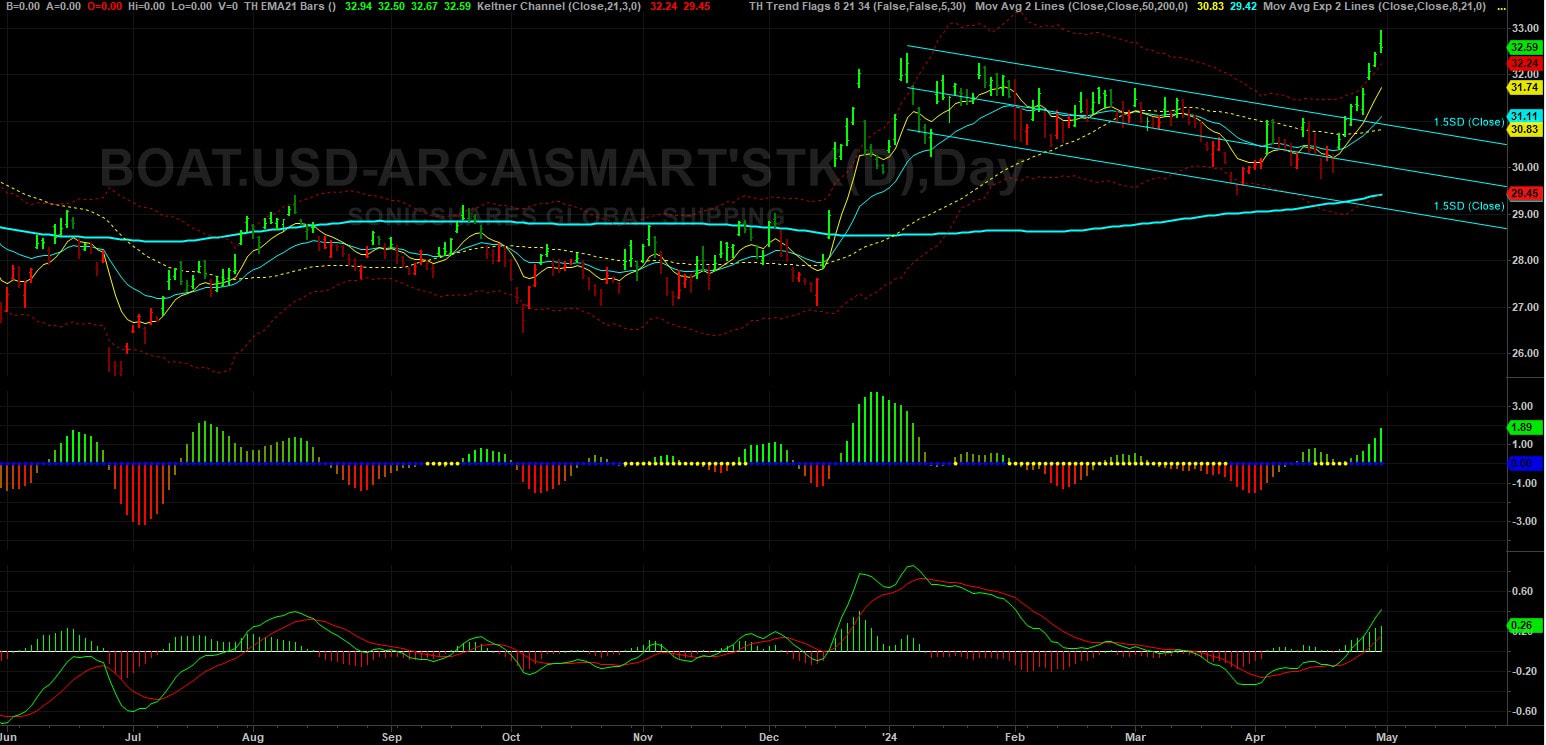

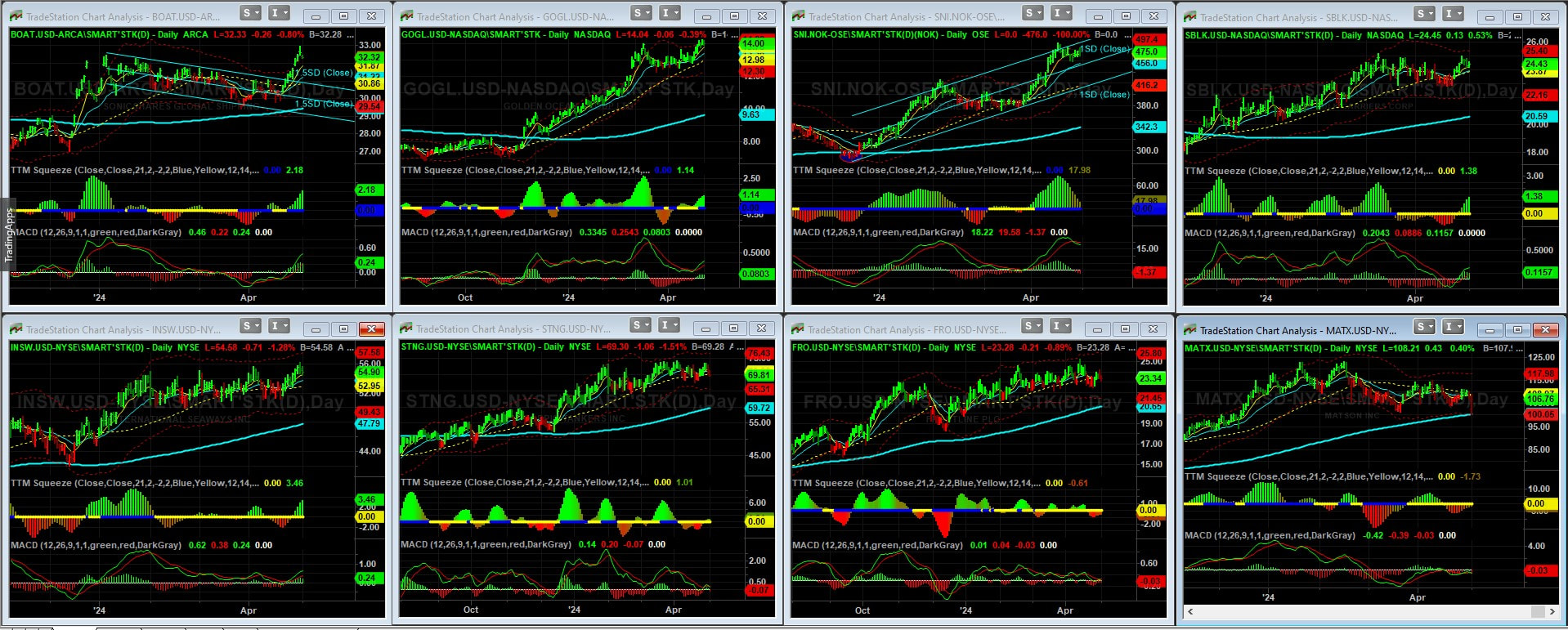

From the Red Sea to the Gulf of Aden, tensions simmer, and the latest focal point of concern is the strategically vital Strait of Hormuz. With over 80% of global goods transported via sea routes, any disruption in these maritime passages sends ripples across the world economy. As we delve into the dynamics of these chokepoints, the stakes become starkly evident. The Strait of Hormuz: A Crucial Artery of Global Trade At the heart of maritime trade lies the Strait of Hormuz, a narrow passage connecting the Persian Gulf with the Gulf of Oman. This vital waterway serves as a conduit for a significant portion of the world's oil and liquefied natural gas (LNG) transportation. With approximately 20% of global crude and refined product consumption passing through its waters, any disruption here reverberates globally. Nations like Saudi Arabia, Iraq, UAE, Kuwait, Iran, and Qatar heavily rely on this route for their oil exports, making them vulnerable to any attempt to block or disrupt the flow. Furthermore, Qatar's substantial LNG exports underscore the strait's growing importance in the energy landscape. Escalating Tensions and Implications The Strait of Hormuz stands at the crossroads of geopolitical tensions, with recent events exacerbating concerns over its security. Incidents such as the seizure of the MSC Aires container vessel by Iranian forces serve as ominous reminders of the risks involved. As tensions escalate, the specter of supply disruptions looms large, with potential ramifications for global oil prices. Already, the market reflects a significant risk premium, underscoring the gravity of the situation. The consequences of any escalation extend beyond the Middle East, with Asian markets particularly susceptible to supply cuts. Global Shipping Chokepoints: A Nexus of Risks While the spotlight often falls on the Strait of Hormuz, other maritime chokepoints face their own set of challenges. From the Strait of Bab el-Mandeb to the Suez Canal and the Panama Canal, disruptions abound, affecting trade flows and economic stability. Attacks by Houthi rebels in the Red Sea, coupled with environmental factors like droughts, further compound these challenges. As geopolitical tensions escalate, trade routes become increasingly politicized, amplifying risks for seafarers and cargo alike. Exploring the SonicShares™ Global Shipping ETF (BOAT) Let's dive into an in-depth analysis of the ETF that offers direct exposure to the bustling global maritime shipping industry. BOAT stands as an indexed ETF designed to mirror the performance of the Solactive Global Shipping Index, aiming to deliver results that align with this benchmark before accounting for fees and expenses. This index comprises a diverse array of global shipping companies engaged in transporting goods and raw materials across the world's oceans, encompassing a wide spectrum of cargo ranging from consumer and industrial products to vehicles, dry bulk, crude oil, and liquefied natural gas. Chart Analysis: BOAT ETF Performance Examining the chart below, which tracks the trajectory of the BOAT ETF, we observe a notable breakout from the recent downtrend, now rallying to new highs. At present, the BOAT ETF comprises 47 global shipping companies. However, we only need to focus on the top 15 weighted holdings within this ETF, as they wield the greatest influence on its overall performance. Our analysis seeks to answer which companies driving the ETF's trajectory and identifying the out performers that will ultimatly go onto our watchllist. BOAT ETF Identifying Outperformers in the BOAT ETF Analyzing the chart depiction below, we pinpoint several shipping companies within the BOAT ETF that exhibit robust performance, as evidenced by discernible uptrends in their price action. Notably, Golden Ocean Group (GOGL) and Stolt-Nielsen Limited (SNI) emerge as relative outperformers within the ETF, boasting well-defined uptrends that underscore their resilience and market strength. These companies are on our watchlist, but it is not time to enter a trade yet. This is where technical tools can be used to time our entry into these markets. We'll be waiting for a reversion to the mean before we go long. Outperformers in the BOAT ETF Conclusion: Navigating Opportunities Amidst Geopolitical Uncertainty

For traders navigating the tumultuous seas of the global shipping market, the recent developments underscore both challenges and opportunities. As geopolitical tensions escalate, maritime chokepoints become focal points of concern, potentially disrupting supply chains and impacting market dynamics. Yet, amidst these uncertainties lie opportunities for astute traders to capitalize on shifting trends and emerging patterns. The recent attention on the Strait of Hormuz highlights the critical importance of monitoring geopolitical developments and their potential ramifications on shipping routes and trade flows. As traders, vigilance is paramount, and strategic positioning can help navigate the complexities of geopolitical risk while seizing opportunities for profit. In this ever-evolving landscape, staying informed and adaptable is key. By closely tracking the performance of key shipping companies within ETFs like BOAT, traders can identify outperformers and leverage their insights to make informed investment decisions. Golden Ocean Group (GOGL) and Stolt-Nielsen Limited (SNI), among others, stand out as promising entities with strong uptrends, presenting compelling opportunities for traders seeking to capitalize on market momentum. As we chart our course through uncertain waters, we need to remain vigilant, strategic, and agile. By harnessing our understanding of geopolitical dynamics and market trends, we can navigate the challenges ahead and steer towards profitable horizons in the dynamic world of global shipping trading.

0 Comments

|

AuthorTim the trader Archives

January 2025

Categories |

Site powered by Weebly. Managed by iPage

RSS Feed

RSS Feed