|

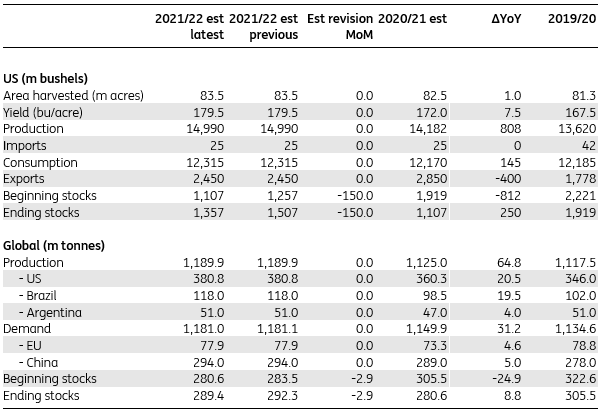

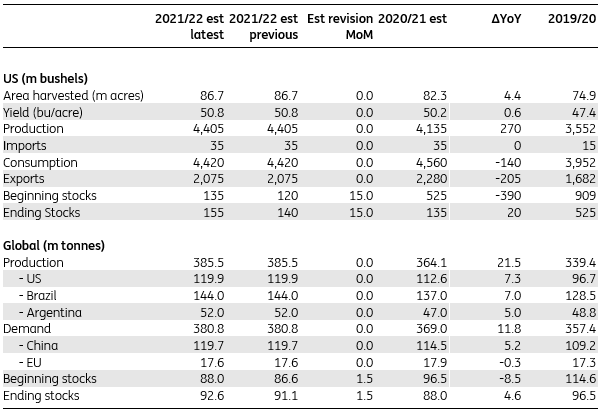

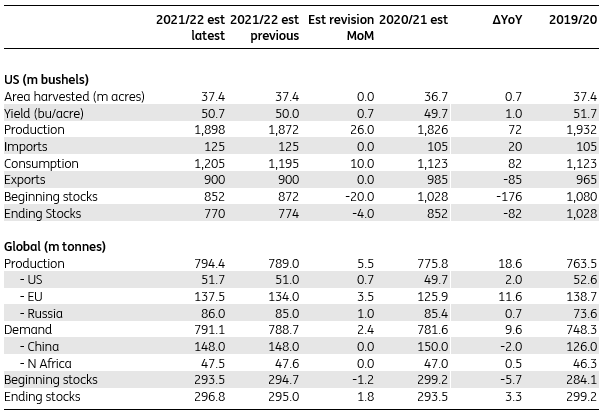

Corn The June WASDE report from the USDA was moderately supportive of corn prices, with changes to the US and global 2020/21 balance sheets leading to a tightening of supply. In the US, both domestic demand and export estimates were increased for the 2020/21 marketing year by a combined 150m bushels. Consequently, US ending stocks decreased to 1.1 billion bushels, which ws below expectations of about 1.2 billion bushels. For the 2021/22 season, there were no changes to the US corn balance. With regards to the global corn balance, the Brazilian corm crop had the largest change for the 2020/21 season. The drought conditions in the region has impacted the safrinha corn crop. The USDA revised the Brazilian production down to 98 million tonnes from 102 million tonnes, which still leaves output higher than expected. For 2021/22, global corn stocks are expected to grow year on year which means there is a probabaility that prices could weaken from current levels as the new corn crop becomes availble, but only if the weather through the summer months is favorable. So weather is the key factor to watch over the coming months. Another key factor is on the demand side and this is the Chinese imports through 2021/22 and wether we'll continue to see the level of demand that we did in 2020/21. The USDA is forecasting that China imports will total 26 million tonnes which is unchanged from eh current season's estimate. Corn Supply/Demand Balance Source: USDA Soybeans The WASDE numbers were not as supportive for soybeans as they were for corn. The USDA revised their US domestic demand estimate by 15 million bushels for the 2020/21 marketing year, and consequentl, ending stocks are coming in at 135 million bushels which was higher then expectations of about 120 million bushels. With regard to the global soybean balance for 2020/21, the market is expecting to see ending stocks edge higher, with an estimate of 88 million tonnes which is anincrease over the previous estimate of 86.55 million tonnes and higher then expectations of about 87.4 million tonnes. The reason for these higher numbers is a softening of demand in the US and an increase in Brazilian production which was revised higher to 137 million tonnes from 136 million tonnes. The 2021/22 global balance sheet saw marginal changes to demand & supply, with higher ending stocks driven by expectations of a larger carryover of inventories from the current marketing year. As a result, global ending stocks for 2021/22 are forecast to increase to 92.55 million tonees with increased output from Brazil, the US and Argentina. This suggests a higher probability of soybean prices trending lower in the next marketing year, assumming that we don't any supply shocks to change the suplly and demand picture. Soybean Supply/Demand Balance Source: USDA Wheat The WASDE reports hsowed the US wheat balance was largely unchanged for 2020/21, however, the USDA did revise the exports higher by 20 million bushels. This leaves ending stocks at 852 million bushels, which ws lower than expectations of about 870 million bushels. Consequently, beginning stocks for 2021/22 are a bit lower but this is offset by expectations of higher output in 2021/22. Ending stocks for 2021/22 are estimated at 770m bushels compared to market expectations of more than 780m bushels. With regard to the global balance, the USDA increased its supply estimates for 2021/22 on higher production from Europe, as recent rains were seen beneficial for the current crop. They also revised global production estimates higher. by 5.5 million tonnes witht he majority of this coming from Europe. Global production is now projected to increase 2.4% year on year to a record high of 794.4 million tonnes. Global demand estimates were also revised higher by around 3 million tonnes, which was mostly driven by Europe. Consequently, 2021/22 global ending stocks estimates were increased by around 1.8 million tonnes to 296.8 million tonnes, which was above market expectations of 294 million tonnes. Wheat Supply/Demand Balance Source: USDA

0 Comments

Leave a Reply. |

AuthorTim the trader Archives

January 2025

Categories |

Site powered by Weebly. Managed by iPage

RSS Feed

RSS Feed