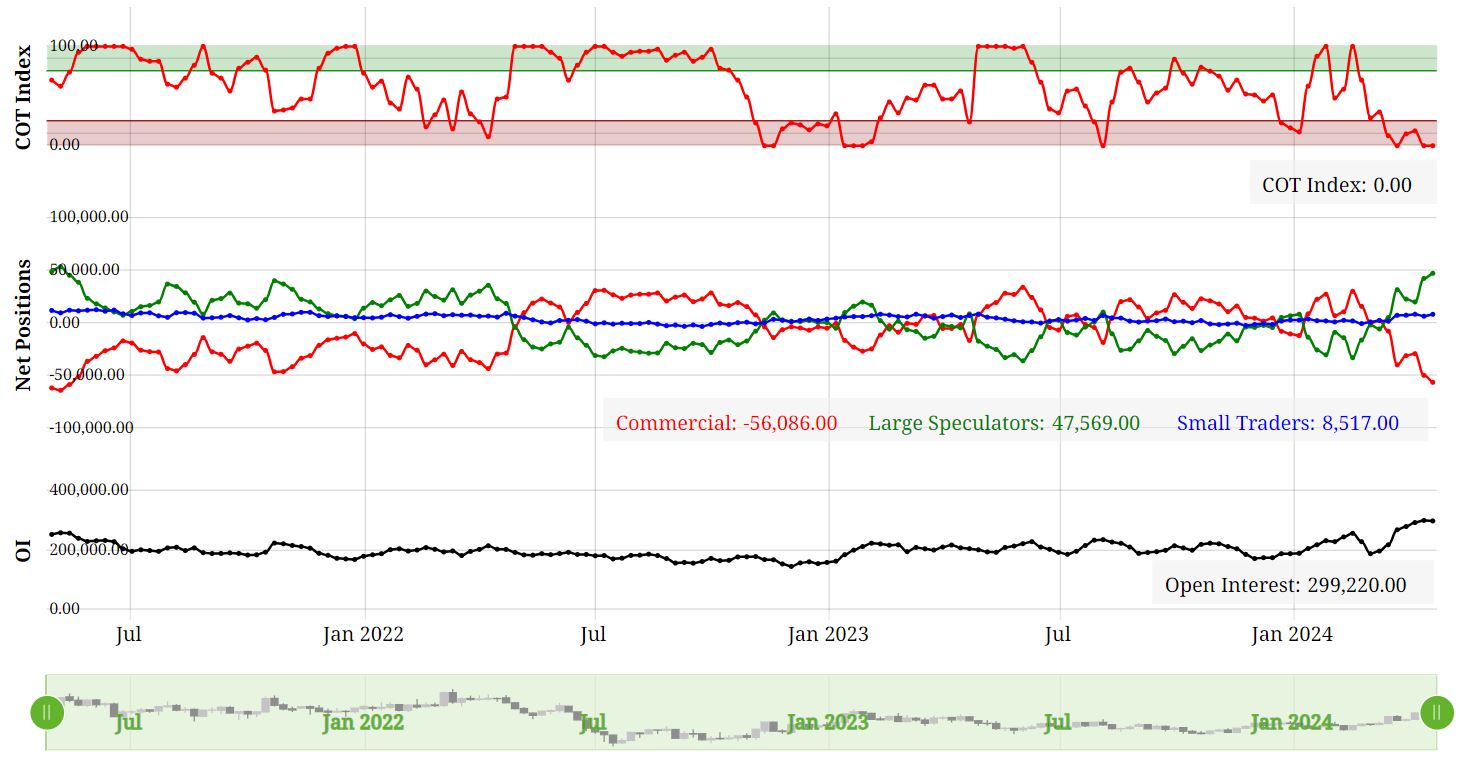

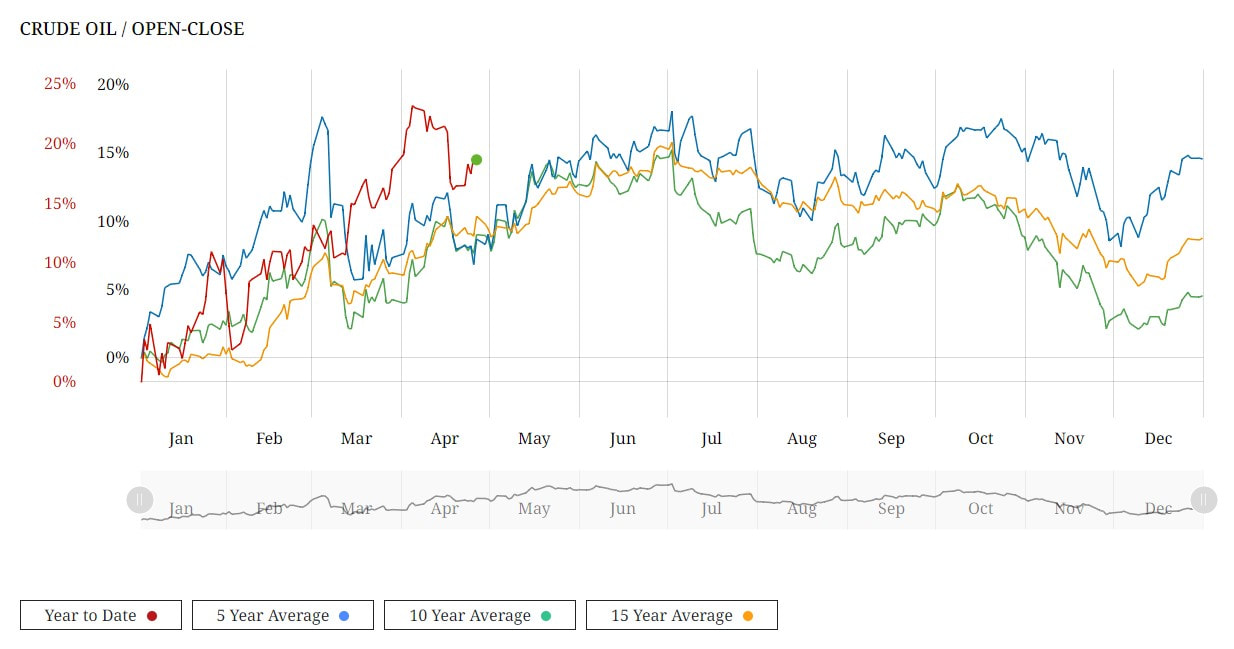

Crude Oil and Gasoline Inventories: A Closer Look The United States witnessed a notable decline in crude oil inventories, with a reduction of 3.23 million barrels reported by the American Petroleum Institute (API) for the week ending April 19. This came as a surprise to analysts who had anticipated a build of 1.8 million barrels. Additionally, the Department of Energy (DoE) reported an increase in inventories within the Strategic Petroleum Reserve (SPR), reaching 365.7 million barrels—the highest level since last April. Market Reaction and Price Trends The news of declining crude oil inventories sparked a bullish sentiment in the market, leading to an uptick in oil prices. This optimism was further fueled by a weakening U.S. dollar index and concerns over sluggish business activity. However, despite these inventory fluctuations, prices have yet to surpass the critical $90 per barrel mark. Factors Driving Price Volatility Several factors have contributed to the recent volatility in oil prices. Geopolitical tensions in the Middle East, particularly the escalating conflict between Israel and its neighbors, have raised concerns about potential disruptions to oil supply routes. Furthermore, macroeconomic indicators such as U.S. inflation data have added to market uncertainty, influencing investor sentiment and price dynamics. Bullish Catalysts and Market Outlook Despite these challenges, oil prices are poised for a weekly gain, driven by a combination of inventory declines, a slowdown in U.S. manufacturing, and ongoing geopolitical tensions. However, concerns persist regarding the sustainability of this upward trajectory, as economic headwinds and supply-side risks continue to loom over the market. Positioning The CoT data shows Funds and Commercials at an extreme level so this warrants caution moving forward. Clearly, this condition can persist for some time but it also opens up the risk of fund liquidation if or when price action move towards 3 standard deviations from the mean. Futures Contract Spreads The inter-contract futures spread in WTI crude oil is currently in backwardation. In other words, the nearby is at premium to the next contract out and this has been increasing over the last few months. It's not a significant premium at this stage, but one to keep on the watchlist. Any escalation in the geo-political situation in the middle-east could drive this premium further. Seasonal Tendancies The seasonal for WTI crude oil has a bullish tendancy from late April into the end of June so this is supportive for the bullish camp. Conclusion

As the crude oil market navigates through a landscape fraught with uncertainty, stakeholders must remain vigilant in their analysis of market dynamics and emerging trends. While recent inventory declines have provided a temporary boost to prices, the underlying factors driving market volatility warrant careful monitoring. By staying informed and adaptable in their strategies, industry participants can navigate the complexities of the crude oil market with resilience and foresight.

0 Comments

Leave a Reply. |

AuthorTim the trader Archives

January 2025

Categories |

Site powered by Weebly. Managed by iPage

RSS Feed

RSS Feed